+ View More Here Should I sign TurboTax consent to disclosure of tax return …ĭo we need to sign it to file or what? Yes, you need to file the consent so TurboTax can efile your returns.

2008-12) for tax return preparers seeking to obtain consent to use or disclose return information from taxpayers … IRS Issues Guidance On Consent To Use, Disclose Return … See some more details on the topic turbotax consent to disclosure here:

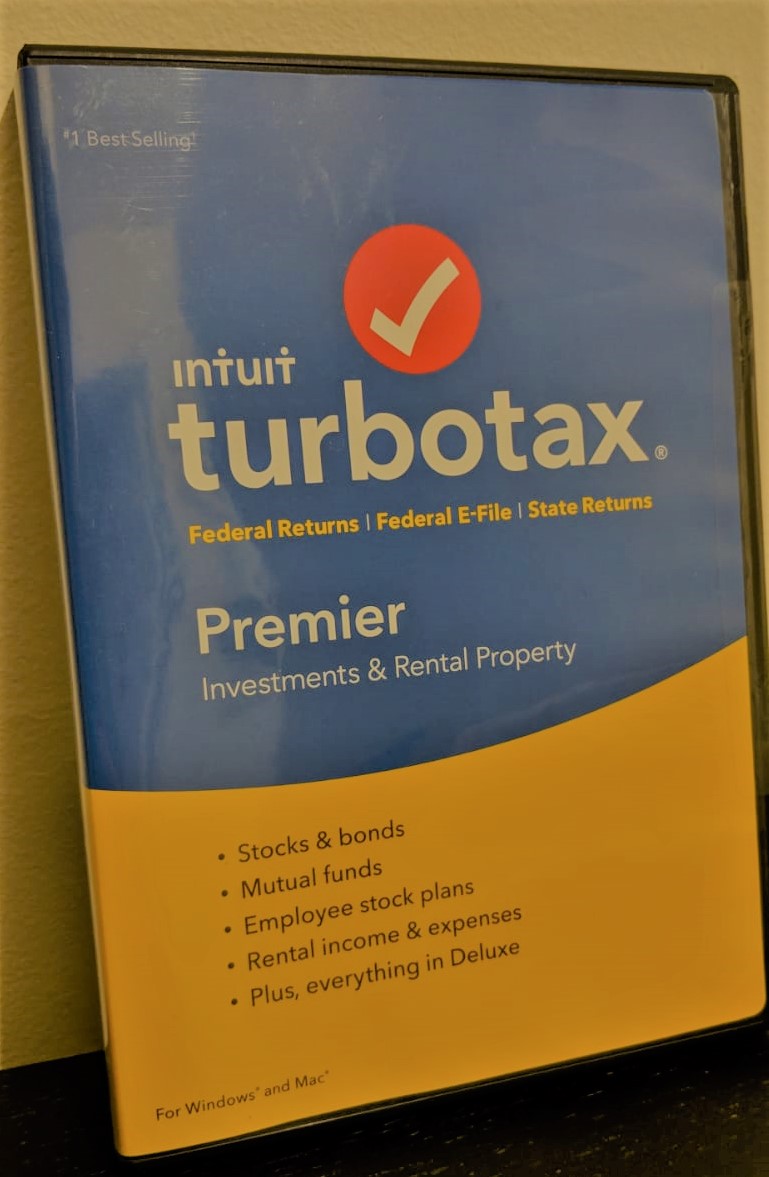

TURBOTAX DELUXE 2017 ONLINE VS DOWNLOAD SOFTWARE

Can TurboTax do form 8949?įorm 8949 is supported in all CD/Download software versions of TurboTax and in the online and mobile app versions of TurboTax Premier, TurboTax Live Premier, TurboTax Self-Employed, and TurboTax Live Self-Employed. What is consent to disclosure of tax return information?Ĭonsent to Disclose: A consent to “disclose” allows the partner to disclose the taxpayer’s tax return information to determine whether the taxpayer will benefit from services offered such as financial advisory and asset planning. It may seem silly, but Turbotax can’t offer you those services unless you officially give it permission to “know” about your tax refund status. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. The tax at your parents’ rate is commonly called “kiddie tax” from the days when it only applied to children under 14. You have to get the information from them. Obviously, in order to calculate the tax at your parents’ rate, TurboTax needs information from your parents’ tax return. It also requires multi-factor authentication every time you log in to verify your identity. Is TurboTax reliable and safe? TurboTax keeps your information secure with data encryption. Images related to the topicWhat is the TurboTax consent form? What Is The Turbotax Consent Form? All you have to do is confirm that it’s correct. TurboTax safely and securely pulls the data. We’ll import it directly to all the right places on your tax return. No need to sift though your documents to find and manually enter information.

It’s mostly to get personalized marketing notices and customized communications, etc. Should I share my tax return with Intuit?Īre you asking about the specific question where TurboTax asks for permission to share your tax info with Intuit? You don’t have to accept that.

If you consent to the disclosure of your tax return information, Federal law may not protect your tax return information from further use or distribution.” Are you asking about the specific question where TurboTax asks for permission to share your tax info with Intuit? You don’t have to accept that.

Unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. Are you looking for an answer to the topic “ turbotax consent to disclosure“? We answer all your questions at the website in category: Newly updated financial and investment news for you.

0 kommentar(er)

0 kommentar(er)